If you only have $100 to start with, you might be wondering if day trading is even possible. The good news is that you can start, but the key is to manage your risk and expectations. With the right tools and discipline, $100 can be a stepping stone to learning the skills needed for trading larger accounts. Let’s break it down.

What Is Day Trading?

Day trading means buying and selling within the same day. Instead of holding for weeks or months, you try to catch small price moves for quick profits.

Think of it like reselling: you buy something at a discount in the morning and sell it for a small profit by the afternoon. Trading works the same way, but with stocks, currencies, or crypto.

Can You Really Start with $100?

Yes, but there are limitations.

- Small profits: Even with a 5% gain in one day, you only make $5.

- High risk: Without proper risk management, one bad trade can wipe out your account.

That’s why the focus should not be on getting rich with $100, but on building habits and learning how to trade safely.

Where Can You Trade with $100?

1. Forex (Foreign Exchange)

- You can trade currencies like USD, EUR, or JPY.

- Brokers often allow “micro lots,” which means you can trade very small amounts that fit a small account.

- The forex market runs 24 hours during the weekdays.

2. Crypto Trading

- Apps like Binance or Coinbase let you start with as little as $10.

- Crypto is very volatile, so while the profit potential is big, so are the risks.

3. Fractional Stock Shares

- Apps like Robinhood or Webull let you buy pieces of a stock instead of needing full shares.

4. Prop Firms

This is a way to access more capital with only a small fee.

- You pay to take a challenge where you prove you can trade consistently.

- If you pass, the firm gives you access to thousands of dollars in trading funds.

- Examples include FTMO, MyForexFunds, and The 5%ers.

With $100, you might use part of it for a prop firm challenge rather than trying to grow your small account directly.

Risk Management: The Key to Trading $100

Here are some tools and techniques that every trader should know:

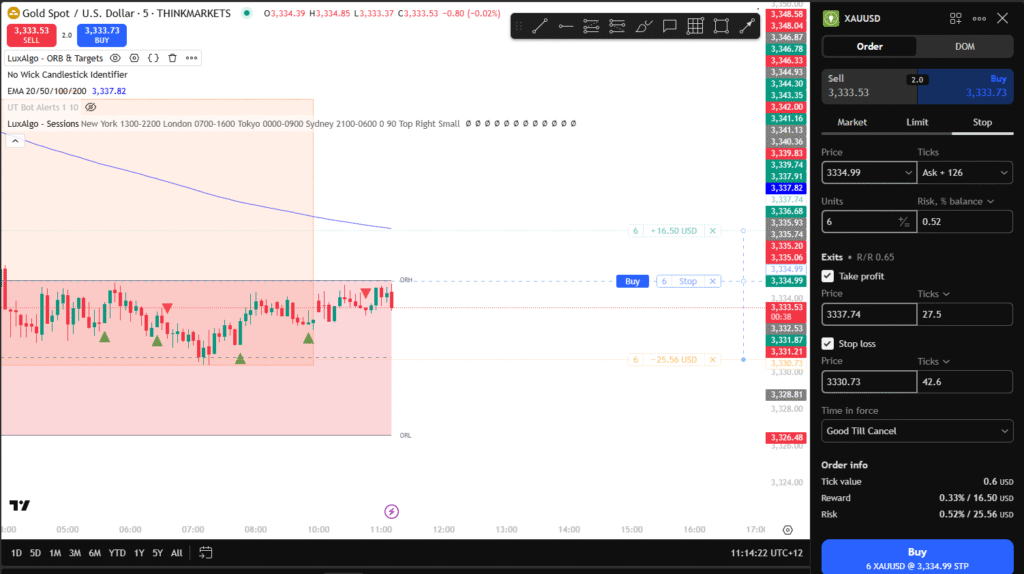

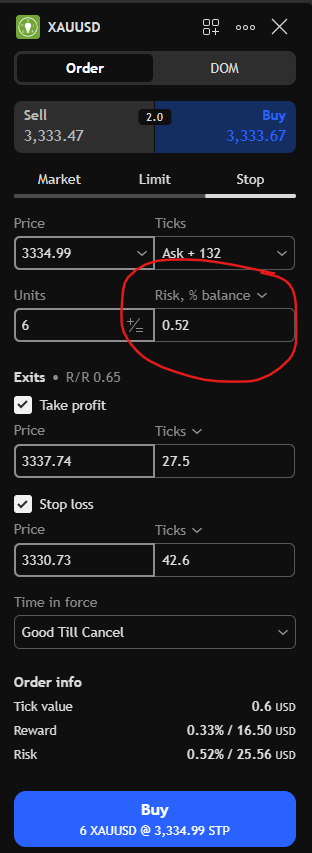

Use a Stop Loss

- A stop loss automatically closes your trade if the price moves against you.

- Example: You buy EUR/USD and set a stop loss 20 pips below your entry. If the market drops, your loss is limited.

Use Small Lot Sizes

- In forex, you can choose micro or even nano lot sizes.

- With a $100 account, risking too much on one trade is dangerous. Keep it small so you can stay in the game.

Move Stop Loss to Break Even

- Once your trade is in profit, you can move your stop loss up to your entry point.

- This way, if the market reverses, you will not lose money on that trade.

Taking Profit in Stages

- Instead of closing your trade all at once, you can take profit at different levels.

- Example: Close part of your trade when you hit your first target, then let the rest run toward a bigger target.

- This locks in some profit while still giving you a chance to earn more if the trend continues.

Tools You’ll Need

- Trading Platform: MetaTrader 4/5 for forex and prop firms, Binance for crypto, Robinhood or Webull for stocks.

- Charting Software: TradingView to track price movements and plan trades.

- Demo Account: A practice account with fake money is a must before risking real money.

Tips for Trading with $100

- Risk no more than 1 to 2 percent of your account per trade. That means $1 to $2 max.

- Use stop losses on every trade.

- Move your stop to break even once you are safely in profit.

- Try scaling out by taking partial profits at different levels.

- Treat your $100 account as practice, not a way to make a living.

Key Takeaways

- You can start day trading with $100, but profits will be small at first.

- Risk management is everything. Use stop losses, small lot sizes, and move stops to break even when trades go in your favor.

- Taking profits in stages helps lock in gains while keeping part of the trade open for bigger moves.

- Prop firms can be a smart way to grow beyond a small account if you can trade consistently.

Starting with $100 is less about making money and more about learning the process. Once you master discipline and risk control on a small account, you can scale up with more funds or explore prop firm opportunities.